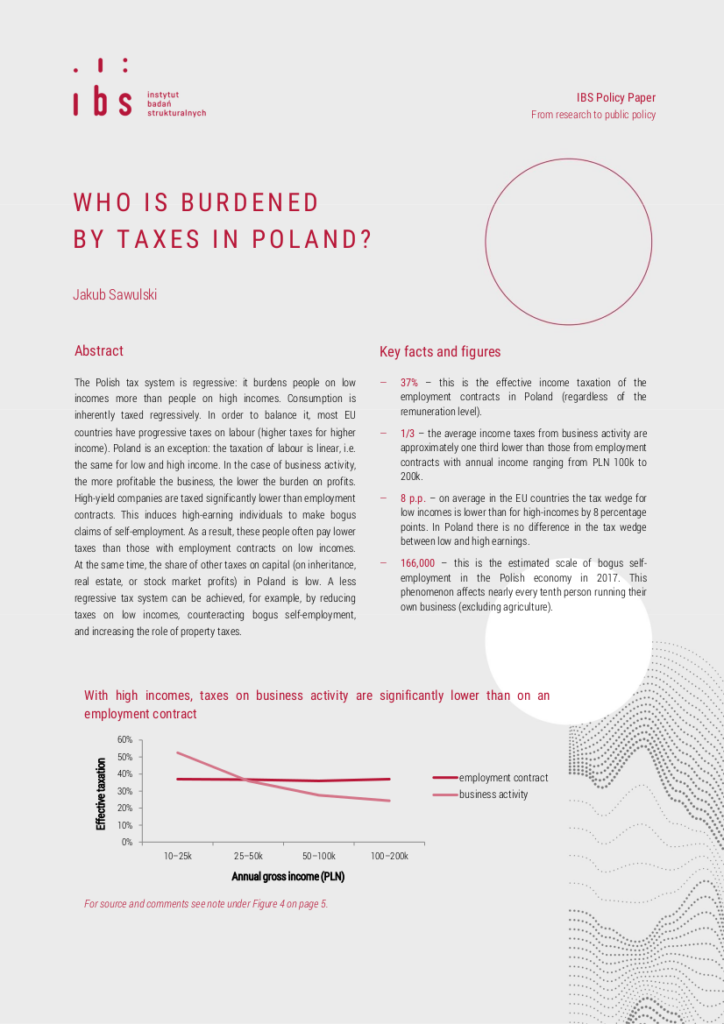

The aim of the study is to find out differences in taxes paid by low earners in comparison to taxes paid by high earners. Our analysis leads to the conclusion that the Polish tax system is regressive: it imposes a greater burden on people with low incomes than on those with high incomes. This is neither in line with the rules of social policy nor with the trends in other countries.

I would like to thank Jan Rutkowski for his helpful comments and remarks. I also thank Aneta Kiełczewska for her help in compiling statistical data. The content of this publication reflects the opinions of the author, which may diverge from the position of the Institute for Structural Research. The usual disclaimers apply. Independent study based on Eurostat, OECD and Ministry of Finance data. These institutions are not liable for the presented results and conclusions.