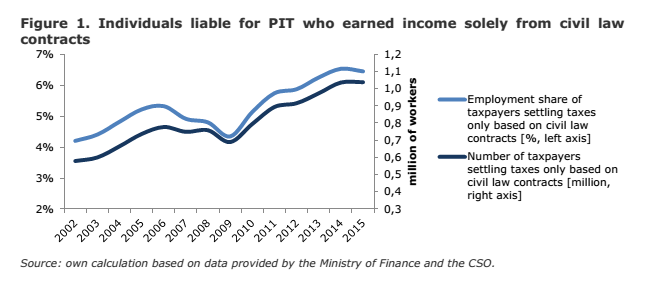

he temporary employment in Poland has risen and now we have the highest share of temporary employment in the EU. Civil law contract are much less regulated than other forms of temporary contracts. According to the LFS data, in 2016 there were 510,000 people working under civil law contracts (in their main job), which is 3.1% of total employment in Poland. The majority worked solely under a contract of mandate (umowa zlecenie) – 429,000 people, and under a contract to perform specified work (umowa o dzieło) – 36,000 people. According to the Ministry of Finance data, the number of people which has been earning income only on the basis of civil law contracts has doubled since the early 2000s.

Workers with civil law contracts and their social protection

In comparison to individuals working under employment contracts, the incidence of civil law contracts is higher among: less educated, younger workers or workers aged over 50, women (mainly because of the different education, age and occupation in comparison to men), employed in low skilled occupations and in small firms. The sectors with the highest incidence of civil law contracts are: accommodation and food services, business support services which include temporary work agencies.

Individuals working under civil law contracts has worse access to social protection system than individuals with employment contracts. Individuals with contract of mandate can be exempted from social security and public health insurance contributions (in some circumstances) or can pay lower contributions. Individuals working under contract to perform specified work are exempted from all social security and public health insurance contributions. However, changes which have been introduced since 2015 improved the situation.

The key challenge: expected low retirement pensions

According to estimates, the pension gap between workers with civil contract and temporary workers will be about 17%. These workers will receive lower pensions even if they spend only a share of their careers working under civil law contracts. Lower contributions paid by civil law contract workers enlarge the deficit in the pension system.

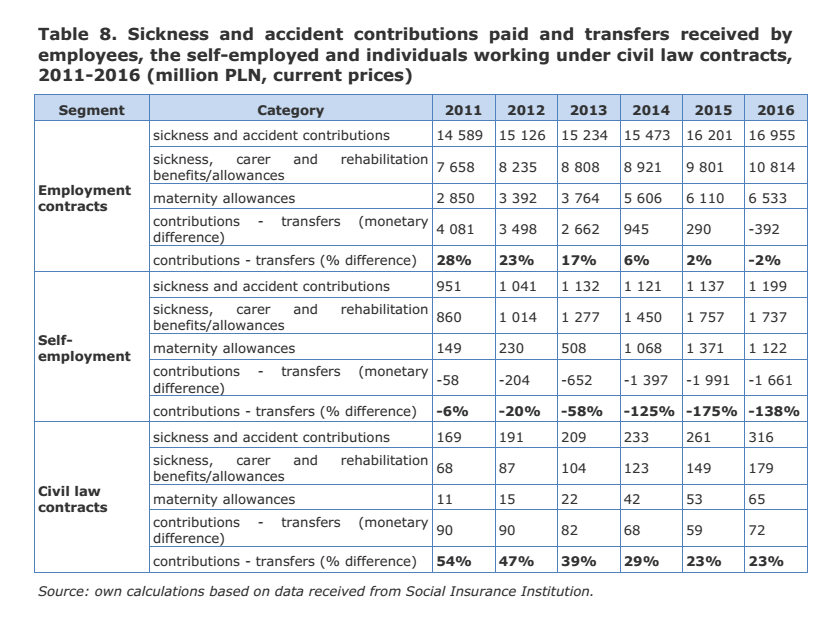

On the other hand, civil law contract workers contribute more in the sickness and accident insurance contributions than they receive in sickness, carer and rehabilitation benefits, and maternity allowances. Overall, they cross-subsidise for example the self-employed. In 2016 contributions paid by people working on civil law contracts amounted to 316 mln PLN, while benefits received – 244 mln PLN. The same values for self-employed amounted to 1 199 mln PLN and 2 859 mln PLN, respectively.

***

The full case study could be find at the Eurpean Commission website.

Please cite as:

Lewandowski, P. (2018). Case study – Gaps in access to social protection for people working under civil law contracts in Poland. European Commission.