The results of the latest research on current and historical levels of economic inequality in Poland and the role of the state were presented in the first part of the meeting. Then we discussed possible instruments mitigating the level of inequality, e.g. minimum wage. See the summary of the seminar and the presentations below.

Is high inequality an issue in Poland?

In the first presentation, Michał Brzeziński (University of Warsaw, Institute for Structural Research) argued that income inequality in Poland is high compared to wealthier European countries, but in comparison to countries in the region and others with similar levels of wealth, Poland ranks more favourably. The relatively high income inequality in Poland results from considerable wage differentials driven by a high education premium, a sizeable concentration of capital income, and a low degree of progressivity of income taxation. On the other hand, wealth inequality in Poland is relatively low, owing to the fact that income differences have not yet accumulated and intergenerational accumulation of wealth has been suspended to some extent during the period of socialism (see IBS Policy Paper).

Top Incomes during Wars, Communism and Capitalism: Poland 1892-2015

Paweł Bukowski (Centre for Economic Performance, London School of Economics and Political Science) presented his joint study with Filip Novokmet on the history of top incomes in Poland (see the paper). Using historical tax data the authors revealed that a period of fairly high inequality lasted between the years 1892-1915, when the income of the top 1% accounted for 10% to 20% of total income. Then, in the after-war period, the introduction of communism significantly reduced inequality by eliminating private capital income and compressing earnings. In the 1990’s top income shares increased back to the level of 10-15% and remain such to this day. In the abstract to theirs paper, Bukowski and Novokmet also emphasised the importance of the source of income: while the initial upward adjustment during the transition in the 1990s was induced both by the rise of top labour and capital incomes, the strong rise of top income shares in 2000s was driven solely by the increase in top capital incomes, which make the dominant income source at the top. (see the presentation)

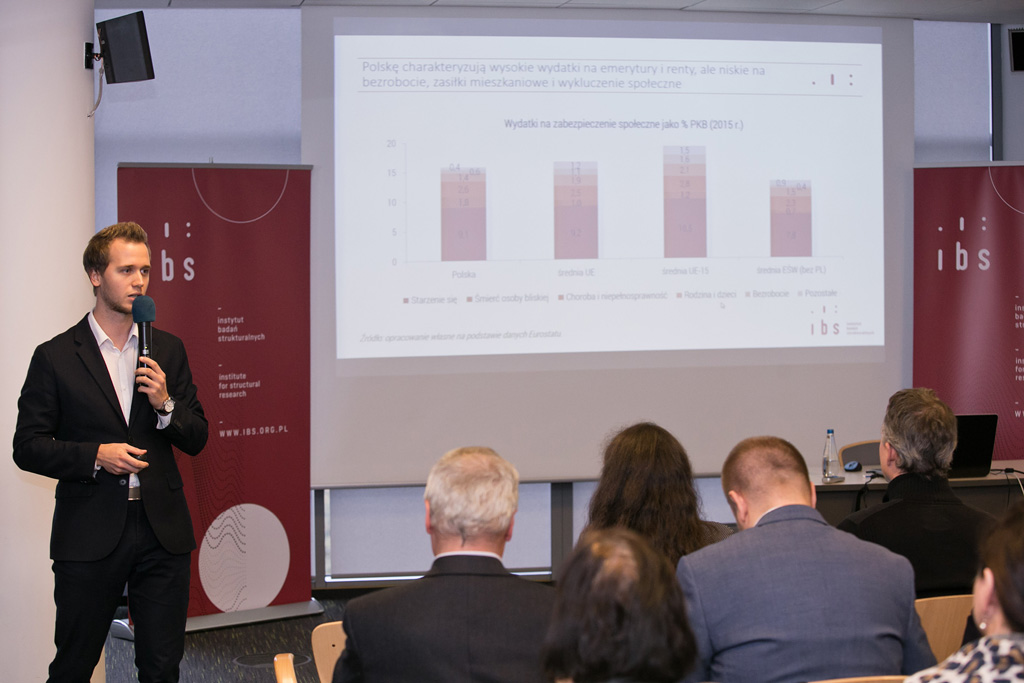

Is Poland a welfare state?

Referring to the topic of economic inequality, Jakub Sawulski (Institute for Structural Research, Poznan University of Economics) presented the results of his latest research on whether Poland is a welfare state or not. He argued that Poland fulfills the criteria of the welfare state, since its social spending is high (26% of GDP) compared to countries with similar income levels. However, after an in-depth analysis of the structure of social spending, it can be seen that the structure of social expenditure in Poland is marked by high pension expenditure (13.5% of GDP, despite the fact that the share of older people in the Polish population is still relatively low). Public health expenditure in Poland is low (4.7% of GDP) and deviates from EU standards. In particular, investment expenditures on medical equipment and outpatient services are modest (-> see IBS Policy Paper).

Non-compliance of the minimum wage and wage gap between women and men in Europe

The minimum wage is one of the social policy instruments that has the potential to reduce inequality. In theory, a higher minimum wage should result in less wage inequality. This effect, however, will not be the case if employers do not obey it – said Karolina Goraus-Tańska (University of Warsaw) in the second part of the seminar. According to the results of her research, the minimum wage in the EU is more often violated in the case of women than men. But if non-compliance of the minimum wage is the case, men are more deeply “unpaid” than women. Goraus-Tańska also pointed out the nuance of those who did not receive financial compensation for overtime worked. In relation to this group, it is also appropriate to talk about non-compliance of the minimum wage, even though those workers formally receive a monthly minimum wage.

Should we reduce economic inequalities and if yes, then how? Conclusions from a panel discussion

The issue of remaining policy instruments which could be used to reduce the level of inequality was discussed by: Michał Brzeziński (University of Warsaw, Institute for Structural Research – IBS), Marek Kośny (Wrocław University of Economics, National Development Council – NRR, Piotr Lewandowski (Institute for Structural Research – IBS) i Ryszard Szarfenberg (University of Warsaw, EAPN Poland). The chair Grzegorz Siemionczyk (Parkiet, Rzeczpospolita) began with the following question: Should we even use social policy to reduce inequality? Michał Brzeziński quickly noted that there is a common belief that the inequality of opportunity, which is responsible for approximately 10-15% of the inequality in income, should be reduced. Marek Kośny (Wrocław University of Economics, National Development Council – NRR) suggested that while we do not know what is the optimal level of inequality and how far we should go in reducing it, we should never let inequality reach a point where it causes social conflict. Hard data is one thing, but social awareness is another, we should tread carefully when inequality approaches an unacceptable level in society – said Marek Kośny.

Inequality in access to education

In the context of unequal access to good education in Poland, Ryszard Szarfenberg (University of Warsaw, EAPN Poland) stated that increasing access to education is conducive to more equal incomes. At the same time, it is important to remember that measuring the impact of monetary transfers on inequality is much easier than in the case of education, health care or other public services. Piotr Lewandowski (Institute for Structural Research) noted that Poland ranks very well in terms of alleviating the impact of having parents without higher education. Regardless, education does not always imply possessing the necessary skills and that the link between education and income is strongly dependant on the socio-economic context.

Addressing the causes or outcomes?

The latter part of the meeting was devoted to the issue of whether more attention should be paid to the causes of inequality, or its effects. Ryszard Szarfenberg correctly pointed out that we have both redistributive and preredistributive instruments at our disposal. The latter, whose aim is to mitigate the causes, are more difficult to implement. According to Michał Brzeziński, these tools are complementary. A good example of a preredistributive policy is public health care, whose quality plays a tremendous role in building human capital. When it comes to redistributive tools, increasing the tax-free allowance has a minor effect. It would be necessary to introduce tax exemptions for low-wage earners and to increase the second tax bracket and the linear tax rate. Brzeziński was quick to note that these are purely theoretical considerations, since raising taxes in Poland is socially unacceptable.

Does reducing poverty increase inequality?

While answering the question posed by Grzegorz Siemionczyk regarding countries which implement anti-inequality policy instruments, Piotr Lewandowski pointed to the Mexican program Oportunidades and the Brazilian program Bolsa Familia. He underlined the fact, that both these programs are conditional cash transfers, and that recipients have to meet certain criteria such as sending their children to school and providing them vaccines. On the other hand, Ryszard Szarfenberg mentioned that some programs whose aim is to reduce poverty can have the adverse effect of increasing inequality. Brzeziński proposed to reinstate the inheritance tax between closest family members as a measure to reduce wealth inequality.

Real estate rental market

Marek Kośny pointed our attention to the fact, that most of the wealth of households in Poland consists of real estate. Drawing on the experience of countries such as Austria or Germany, which both have a deep real estate lease market, shows that this poses the risk of increasing inequality. While he is not against measures which would give this market a boost, it is important to bear in mind this risk.

Basic income

The discussion ended with an analysis of the basic income concept. The panellists agreed that this could be a good solution to the problems of developing countries, where the welfare state is non-existent. However, developed countries should look for more nuanced policies. Brzeziński pointed out that basic income in the amount of the poverty line in Poland would cost approximately 10% of GDP, which is simply not feasible.

photos: Kuba Kiljan (photo gallery)

***

The seminar was financially supported by the Minister of Science and Higher Education in Poland from resources for science dissemination (No. 892/P-DUN/2017).

IBS_seminar_inequalities_23.10.2017_agenda.pdf

IBS_seminar_inequalities_23.10.2017_agenda.pdf

P.Bukowski-Top-Incomes-during-Wars-Communism-and-Capitalism-Poland-1892-2015-1.pdf

P.Bukowski-Top-Incomes-during-Wars-Communism-and-Capitalism-Poland-1892-2015-1.pdf